ENTRY OF NONCURRENT JOURNAL ENTRIES

Generally, systems allow quite a bit of flexibility with regards to journalizing activity for prior or future accounting periods. This is most helpful in recording accounting activity that occurs outside of the current period.

Each journal entry has two dates associated with it: the posting date and the accounting date. The posting date indicates the date on which the journal entry was posted to the accounts. In most cases this is the date the journal was created. The accounting date, also called the effective date, determines the period to which the journal entry should apply. When the accounting date refers to a future period, the entry becomes a future period entry. When the accounting date references a prior accounting period, the entry becomes a prior period entry.

Each accounting company has a posting status parameter on the company table that specifies which (prior, current, and future) accounting periods remain open to receive journal entries. In other words, this parameter identifies the range into which the accounting date is allowed to fall. In addition to the current period, organizations typically leave one or two prior periods and one future period open to posting. This window may be changed at any time.

All of this may seem simple, but processing prior period adjustments requires understanding more than just how open periods can be controlled.

Accounting for Prior Period Activity. Prior period entries occur due to many different circumstances: litigation, audit adjustments, and late-arriving information are a few common reasons. During any particular accounting period, accountants may leave one or two recent prior accounting periods open to posting on the system in order to readily accommodate prior period adjustments that affect these periods. With some additional measures, the general ledger system may accommodate certain adjustments to older prior periods, should such a need arise.

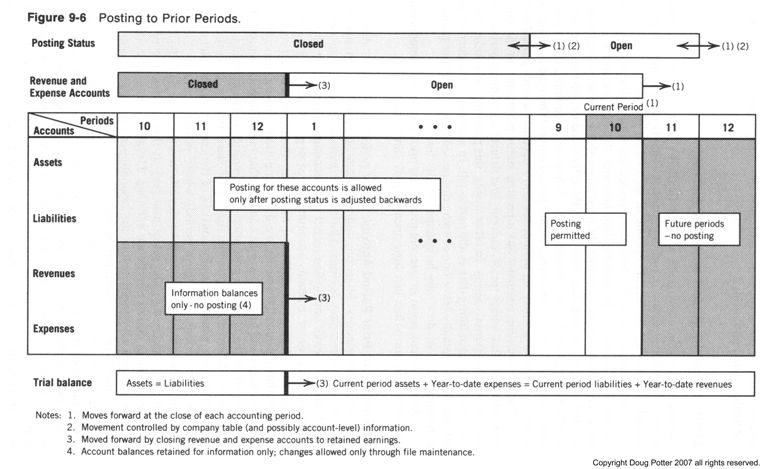

To understand how this works, consider that two different, controllable time windows affect the ability to post prior period entries to the general ledger chart of accounts. Referring to Figure 9-6, the first of these time windows is for posting status. This time window usually consists of the current period and one or two recently past periods. For those periods whose posting status is "open," the system is allowed to process journal entries effective for those periods. The second time window is defined by the set of past periods that has had the revenue and expense accounts closed to retained earnings. Usually the closed portion of this window includes all periods before the beginning of the current year; the open portion consists of all subsequent periods.

Figure 9-6 illustrates how these time windows are adjusted and how this affects the processing of period adjustments. The white posting status area represents periods that can receive journal entries. By changing the posting status window (usually represented by the number of open periods), an accountant can post prior period entries to any account in the lightly shaded area of the accounts. When this occurs, any change made to an asset or liability account's balance will carry forward to be reflected in the current period. Prior period adjustments to open revenue and expense accounts are not carried forward in this manner, but will be reflected in current or future retained earnings when these accounts are later closed.

Prior period journal entries may not affect closed revenue and expense accounts (although the system may allow their amounts to be adjusted via file maintenance to account balances). The net revenue and expense effect of the prior period journals for these older periods must be reflected in a balance sheet account, such as Retained Earnings or Correction of Prior Period Errors. Driven by accounting principles, some organizations use the latter account to isolate the retained earnings effect of the prior period adjustments and report this as an adjustment to opening retained earnings in the year's Statement of Retained Earnings.

Accountants generally do not go through such great lengths to post prior period adjustments for immaterial amounts. When the prior period adjustment is immaterial, it may be recorded in the current period and appear as part of the current year's financial statements. However, the cumulative effect of several immaterial adjustments may be material. Moreover, the cumulative affect of these adjustments may not be known until the end of year arrives. This builds a case for using the Correction of Prior Period Errors account to isolate the cumulative retained earnings effect of prior period activity.

Whenever processing prior period adjustments, the general accounting department must use judgment to determine whether financial and management reports for these prior periods should be rerun and disseminated. Certainly this should occur for more material adjustments.

Future Period Entries. The accounting department may allow the general ledger system to accept journal entries for future accounting periods. This capability is most useful during the beginning of a new period when transactions for both the previous and the new period may be received before closing the previous period. Many general ledger systems hold future period journal entries in suspense and do not post them until their accounting date coincides with the current period. (See periods 11 and 12 in Figure 9-6.) While in suspense, these future period entries may be reported on a batch listing of suspended journal activity.

Those general ledger systems that allow posting of such future period entries must exclude all future period activity from current period reporting. Regardless of which posting approach is used, it is important for the system to accept future period journal activity so that the general accounting department can enter any such transactions into the system, date them accordingly, and know that they will affect the proper financial periods

SUMMARY OF JOURNAL PROCESSING FEATURES AND CAPABILITIES

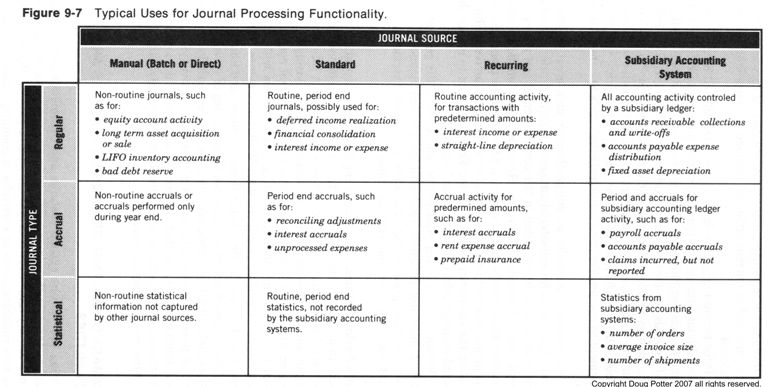

To bring the various system features and capabilities just discussed into perspective, consider that some of these features describe the source for creating journal activity and some describe the type of journal. Figure 9-7 identifies how these two variables apply to particular accounting situations. The particular situations shown (in the cells of the matrix) follow a strategy of placing minimal reliance on manual journal entries, preferring to use the more automated journal entry sources to account for particular business activities.

Figure 9-7 identifies a new type of journal entry not yet mentioned—the statistical journal entry. These journal entries differ from financial journal entries in that they are one-sided and do not balance debits equal credits. They are used to record non-financial activity such as number of employees, number of new orders, or units of production. The general ledger system typically requires that statistical entries be posted only to statistical general ledger accounts. Not all systems use a separate type of journal entry to record statistical activity, however. Some general ledger systems use a less flexible approach of allowing statistical activity to be journalized and stored as part of a financial journal.

Particular general ledger systems may define additional or different types of journal entries relating to specific situations. Examples include additional journal types defined for prior period entries, future period entries, or certain entries generated internally by the general ledger system, such as cost allocation entries.

The three journal types shown in Figure 9-7 are the most common across all systems.

9.4 POSTING

Following journal entry, the posting process updates the account balances in the general ledger master file that are affected by each accepted journal entry. However, updating account balances is only one of several functions performed during posting. Other functions include updating the journal history file with posted journals, processing journal entries in error, and preparing certain reports.

JOURNAL PROCESSING AND EXCEPTION HANDLING DURING THE POSTING CYCLE

During posting the system edits each journal entry, in some cases duplicating edits that were performed during the creation of manually entered batches. These important tests verify that each journal entry refers to a valid, open account and that it balances, debits equal credits. Any journal entries rejected here are isolated for further follow-up. The system may allow rejected journal entries to be handled using either one of two approaches:

• The system may reject journal entries that are in error, by placing them into a suspense file.

• It may accept out-of-balance journals or journals with invalid account numbers, and change the journal to use a system-generated offset account to suspend the journal items in error.

Under the first approach the system recycles journal activity back into the suspense file for subsequent correction. To complete the processing of rejected journal activity, an accountant must review the system's report of the posting process, review the contents of the suspense file, and correct these journal entries on-line. This process accounts for the feedback loop of suspended journal entries back into the posting process.

The second approach, using a suspense account, allows all journal activity to be posted to the ledger, but an accountant must review the suspense account balance after each posting run. If the balance on this account is nonzero, then he must research what caused any activity on that account and reverse this activity to bring the account balance to zero by the end of the accounting period. Suspense accounts are usually designated by a special account number, such as "9999."

The operational trade-offs associated with either one of these approaches are generally insignificant and do not favor either approach. Both approaches are quite popular.

Often accounting department procedures require that posting be performed flawlessly at a designated time, possibly to adhere to a period end closing schedule. To prepare for this, the system can allow a preposting run that tests the journal entries' ability to be correctly posted without actually updating any account balances. The system reports the results of this preposting run, allowing an accountant to perform needed corrections on the batches of journal entries before the live posting run occurs.

Next Month's Topic: POSTING REPORTS