ACCOUNT SUMMARIZATION

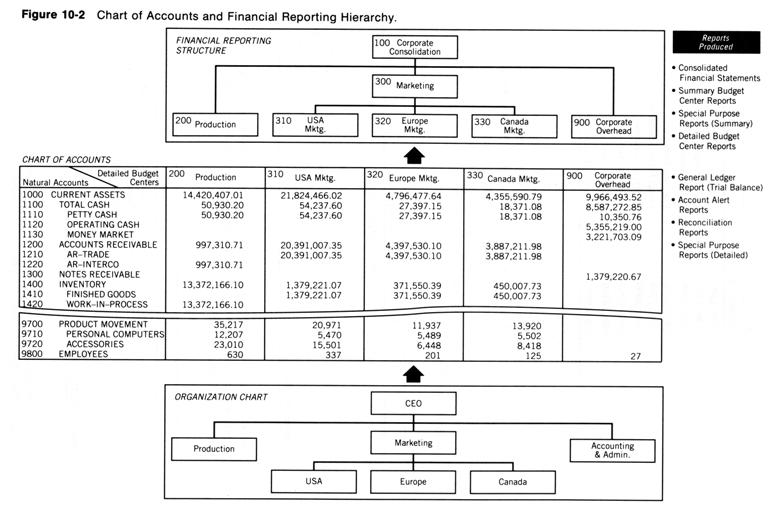

Certain natural accounts in the chart of accounts retain summary information, calculated by accumulating account balances from other natural accounts. General ledger systems often implement this concept by recognizing two categories of natural accounts. Detailed accounts, also called posting accounts, contain the lowest level of account information and have their account balances updated through the journal entry process. Summary accounts have account balances that are defined as totals of other account balances both posting and summary. As Figure 10-2 shows, if an organization has the three different cash accounts—Petty Cash, Operating Cash, and Money Market—they would likely define the summary account for Total Cash as being the total of these three posting accounts.

Summary accounts store financial totals and are a logical extension of the basic accounting detail defined lower down in the chart of accounts. Summary accounts may also be thought of as a tool for organizing natural accounts on financial reports. Items generally chosen for summary accounts are financial data elements that appear on important management reports; they represent a unit of financial information significant to management. Once a summary account is defined, it applies uniformly to all budget centers.

General Ledger System Features. For these reasons, the general ledger system should have a facility for defining summary accounts and making them easily accessible for financial reporting. Earlier general ledger systems relied on a financial report writer to create account summary information separately for each financial report. More modern systems allow the summary accounts to be predefined in the chart of account structure.

Not surprisingly, summary accounts have many properties of the posting accounts:

• They can retain debit or credit balances.

• In most general ledger systems they have a complete general ledger master file record.

• They apply to each budget center associated with the posting accounts.

• They are either an asset, liability, revenue, expense, or statistical account.

But unlike posting accounts, summary accounts cannot be posted to Also summary accounts usually do not appear on general ledger detail reports that must foot, debits equal credits. (Their balance can throw the footing off by double counting detailed accounts.) For example, the general ledger report shown in Figure 9-12 does not show any summary accounts. On the other hand, summary accounts would likely show on a detailed listing of accounts that is not required to toot, such as a listing of year-to-date account activity by account.

Some systems retain an active balance for each summary account. The system updates this balance each time one of the associated accounts is posted to. An alternative implementation of summary accounts provides the appearance of an active balance, but actually recomputes the balance from the underlying detail accounts each time this summary information is requested.

Approaches for Defining Summary Account Structure. Obviously a summary account represents a grouping of other accounts. General ledger systems use either one of two approaches for grouping and organizing (posting and summary) accounts to define a new summary account. One design uses significant digits in the account number or significant information stored in the general ledger master record. This creates a relationship that is implied in the account number (or master file record).

When this implicit architecture is used, the system usually stores that summary account record in sequence with the other accounts in the general ledger master file. A special code on the account record indicates its summary account status. During posting runs, the system's totaling logic uses the account numbers or account codes for totaling other accounts into the summary accounts. This allows the system to easily retain an updated summary account balance for subsequent inquiry or reporting.

Figure 10-4 lists certain characteristics, any one or two of which can indicate this approach. In this example, note that the Current Assets summary account is defined from other summary accounts. Note also that these accounts are frequently coded with a natural account number that ends in "0" or "9."

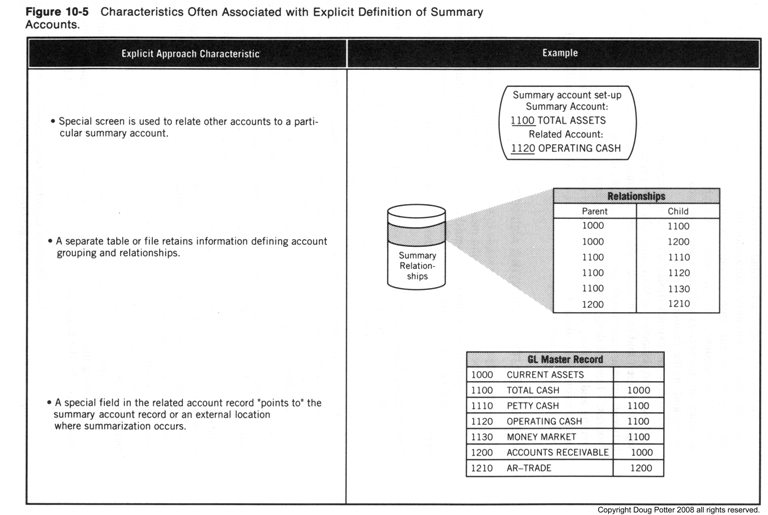

As an alternative to this implicit approach, the general ledger system may retain information about account summarization outside of the account number (or outside of the master record). It does this by using other tables and external information to describe a relationship between summary accounts and posting accounts. This indicates an explicit approach to account summarization. Figure 10-5 shows characteristics indicative of this approach.

An explicit approach may hold the summary account record in the general ledger master file, with other account records. Often, however, the summary record exists outside of the general ledger master file. In either case the posting process uses this explicitly defined relationship to roll account balances up from the detailed posting accounts into the summary accounts.

Benefits of an Implicit Approach. There are several reasons for having summary accounts in the general ledger. They help reduce the need to redefine for each report, financial totals that would likely appear on any financial report. They allow the system to easily support on-line inquiry of summary account balances. Also each summary account represents a piece of financial information that helps tie together the detailed accounts, thus making the chart of accounts more complete.

Either approach to account summarization—implicit or explicit—requires the accounting department to define each summary account and define its relationship to the accounts that accrue into it. But a general ledger system that uses an implicit technique for account summarization offers several benefits over one that does not.

First, requiring the use of significant digits in the natural account number forces the accounting department to maintain a somewhat rigid structure in the account number. This rigidity is not disadvantageous. It helps prevent the account numbers from being assigned haphazardly. Explicit approaches lack this rigidity and can more easily allow accountants to create situations in which summary account numbers do not resemble the associated detail account numbers.

Figure 10-4 Characteristics of Implicit Approaches to Account Summarization

Second, this approach usually provides an easier and more logical way for mapping account summary information into the financial reports that will be produced by the system. Since a straight listing of the accounts exactly mirrors how, and in what sequence, the accounts will map into the financial reports, the accountant always sees exactly the same sequence of accounts—both on the account listing and on the financial reports.

Finally, the explicit design uses more screens and tables and, as a result, becomes more complex to learn and use. The explicit approach typically uses a separate screen and/or an extra table for retaining the structure, or relationship between summary and detail accounts. An implicit design does not require these "extras." Implicit designs tend to use the same screen for maintenance of both posting and summary accounts and they do not require a separate table for retaining information about the structure since the structure is implicitly designed in the natural account number.

NEXT MONTH'S TOPIC: Responsibility Accounting and Reporting