GENERAL LEDGER SYSTEM TABLES

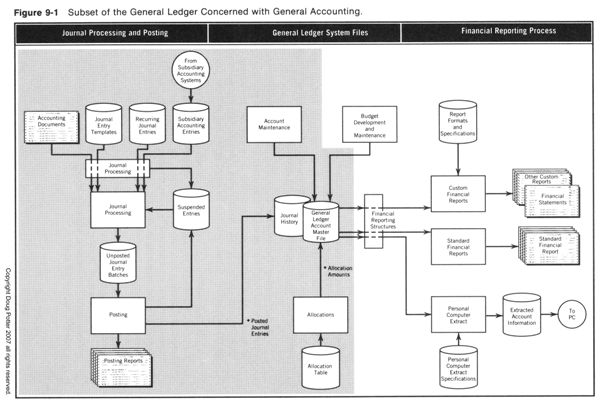

Notice that the overview in Figure 9-1 does a good job of showing the role of the major system files—the general ledger master file and the journal history file—but it fails to point out how certain important system tables relate to the processes described. Indeed the general ledger system relies on a set of tables, or small files, to support a wide variety of system features and functions. Although specific tables may vary somewhat from one general ledger system to another, the tables commonly used (and mentioned throughout this book) include

• The company table, which is used to store information for each accounting company.

• The calendar, which retains dates marking the beginning and ending of each fiscal period.

• The budget center table, which defines each budget center in the chart of accounts.

• An allocation table, which retains the information required to perform allocations.

• A table of financial reporting relationships, which defines the reporting hierarchy among budget centers in the chart of accounts.

The company table retains information about each accounting company defined to the system. This information includes company-wide defaults, reporting parameters, and processing information, such as the number of open accounting periods. Figure 9-19 shows an example of a company table maintenance screen. Organizations use the information in this table to control processes affecting all the accounts in a particular accounting company. For example, based on the default journal edits of Figure 9-19, journal entries with detailed line items over $100,000 will receive a warning when they are entered (presumably prompting the accountant to verify that the amount is accurate).

Other tables are further explained in other articles in this series.

9.7 SPECIAL FEATURES

Certain business environments have special requirements for general accounting that demand specific adaptations or special features in the general ledger system.

In most cases these adaptations fall closely within the constraints of the system features and capabilities discussed so far. In some cases, however, they require new system features.

PROJECT ACCOUNTING

Businesses sometimes need to isolate and track financial activity associated with a particular project or event. Project accounting has applications in capital budgeting and capital expenditure tracking as well as less rigorous applications for generalized project management, including

• Monitoring costs for special construction activities, such as a new building or a new facility.

• Monitoring the costs associated with the introduction of a new product.

• Isolating and reporting the labor and overhead costs for a newly added second production shift.

When meeting this requirement is a significant financial control and reporting issue, an organization will usually employ a project management system that

• Reports progress in graphic form.

• Monitors and reports project resource commitments.

• Schedules activities and resources.

• Provides a variety of related features for task-level budgeting and progress reporting.

In the absence of such a functionally complete project management system, the organization can use the general ledger system to track and report project financial activity.

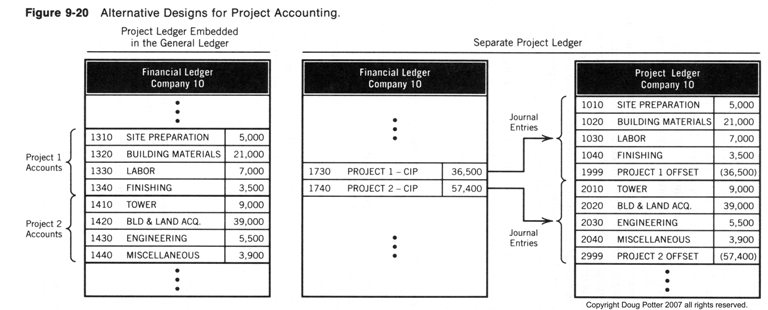

To accommodate project accounting, the general ledger system uses a subsidiary ledger for storing and reporting project financial activity. This subsidiary ledger can either be a subset of the affected accounting company's ledger, or maintained separately under a different accounting company (Figure 9-20).

Project Ledger Imbedded in the General Ledger. This approach to project accounting is perhaps simpler, requiring less sophisticated capabilities of the general ledger system. It features the encoding of all project account detail into the main chart of accounts. Unfortunately, this approach tends to clutter up the main chart of accounts with project-related details, such as project account numbers and estimates-to-complete. Because of this, the associated account maintenance efforts and the posting of project ledger activity become closely tied to (and can sometimes interfere with) posting and closing general financial activity.

Separate Project Ledger. Using a separate project accounting ledger set up under a different accounting company creates a slightly more complex environment, but it better insulates the main chart of accounts from the nuances of the project ledger. Special system features required for this approach include the ability to

• Encode project-specific account information in general financial journals.

• Create project ledger journal entries by reformatting general financial journals.

This second point refers to the need to take project-identifying information from the financial journal and, from this, form ajournal that will post to the project ledger. The journal preprocessor is the most likely tool for accomplishing this.

The design for a separate project ledger shown in Figure 9-20 represents one approach to this. Variations of this design include

• Creating separate accounting companies for different projects.

• Posting to the project ledger before the financial ledger.

• Using the preprocessor to first split each project journal, yielding from one single journal, both a financial and a project journal that are then simultaneously posted to respective ledgers.

Several other considerations set this approach apart from imbedding project accounts into the general ledger. First, this approach necessitates reconciliation. Because a separate subsidiary ledger holds project accounting activity, all project activity posted to the project ledger should be reconciled to the general ledger. This can be a reconciliation of the project ledger's balances against the main financial ledger, or a reconciliation of the journals extracted from the financial ledger to those journals posted to the project ledger. The former approach is preferred.

Another consideration of this separate project ledger approach is setting up a control account in the subsidiary ledger. Because all accounting companies must maintain a balance of debit and credit accounts, each project (technically each accounting company) must have an offset account. This account not only serves to meet accounting company balancing requirements, but also may be useful for reconciling the project ledger to specific accounts in the main ledger. For example, if the project expenses are represented in the main ledger as a single expense account, then the two ledgers are in balance when this expense account balances to the subsidiary ledger offset account.

There are two important advantages of using separate project ledgers. One includes the ability to capture project activity that occurs from more than one accounting company. With a project ledger imbedded in the general financial ledger, this is not possible. The second advantage stems from the ability to easily store and report period-only project expenditures even though the project involves capital asset formation.

To expand on this second point, consider that capital projects in the main financial ledger must be represented as asset accounts, showing only the lump sum account balance each period, but management often views capital budgeting and reporting in terms of the period-by-period expenditures for particular projects. Maintaining project accounting records in expense accounts (in a separate project ledger) creates this period-by-period record of expenditures, which can be more useful for project budgeting and reporting than the lump sum balances that would be reported in asset accounts.

This flexibility associated with using a separate project ledger can be either an advantage or a disadvantage, depending on the circumstances. It becomes an advantage if needed functionality can be achieved easily with this approach. It becomes a disadvantage if the resulting environment becomes difficult to build or maintain.

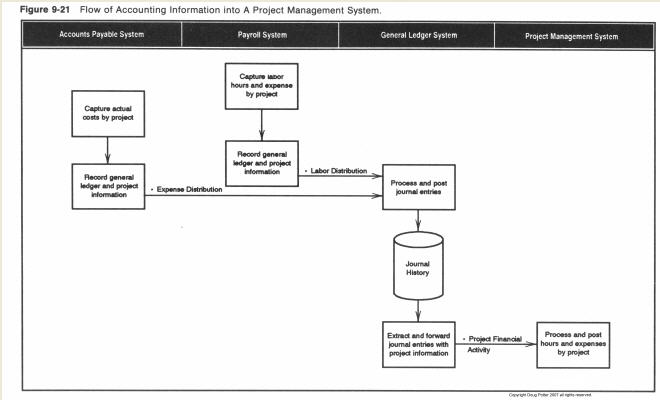

Using a Separate Project Management System. Both the approaches shown in Figure 9-20 rely on general ledger system features for meeting project accounting and reporting requirements. With these approaches, requirements for project budgets, estimates-to-complete, and project-specific financial reports can all be met with standard general ledger system features. Should more extensive requirements exist, an organization may employ a separate project management system to manage and report all project activity. In this case, project financial activity can flow into the project management system using a design similar to the ones just discussed. Figure 9-21 shows an overall picture of this approach. Allowing project financial activity to be received first in the general ledger and then forwarded has some benefits. For example, this approach simplifies the collection of project information and usually makes general ledger account reconciliation an easier, more straightforward task.

Next Month's Topic: Allocations