POSTING REPORTS

At the conclusion of the posting cycle, the general ledger system will prepare various reports. Many of these are optional and can be produced based on particular needs. One that is not optional is the general ledger journal.

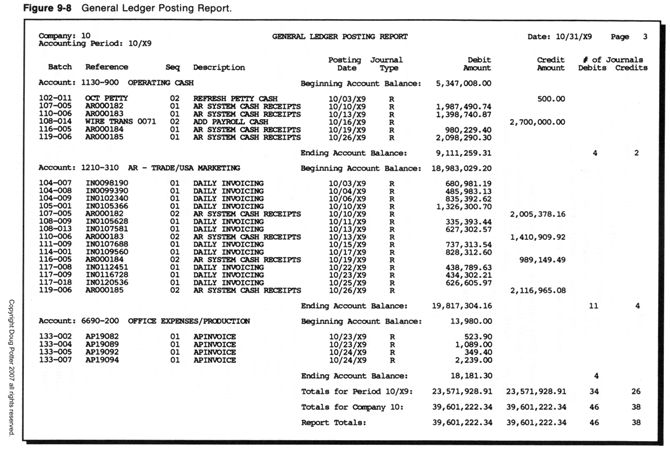

General Ledger Journal. The general ledger journal usually shows each affected account, its beginning balance, all debit and credit transaction detail, and the account's ending balance (Figure 9-8). Rather than a listing of journal entries, this report is more of an audit trail of posted account activity. The sorted sequence of Figure 9-8 is one of several variations for reporting this information:

• Sort by accounting company, accounting period, account number, and journal entry (Figure 9-8).

• Sort last on accounting period, showing journals by accounting periods together under the same account number.

• Optionally include control totals and/or detail by subsidiary accounting system (e.g., accounts payable system).

• Exclude all account-level detail, but print only the appropriate totals (e.g., by accounting company, showing period and subsidiary accounting system totals).

Report totals are useful for balancing and spot-checking the posting activity. Organizations that use this last approach should have a system well equipped for viewing any historical transaction detail on-line. Regardless of the request format, the report totals should convey both the number and dollar amount of journal activity as well as any suspense account activity that might have occurred.

Accountants typically file this report by date for each accounting company to create a complete record of all posted general ledger activity. Some organizations retain this information as part of the permanent accounting records. When showing account detail, this report provides a complete audit trail of the general ledger accounting records, effectively supporting the financial statements. In organizations that report only aggregate totals of posting activity, the account-level detail records are stored on computer-readable media and may be retained historically, in lieu of the printed reports.

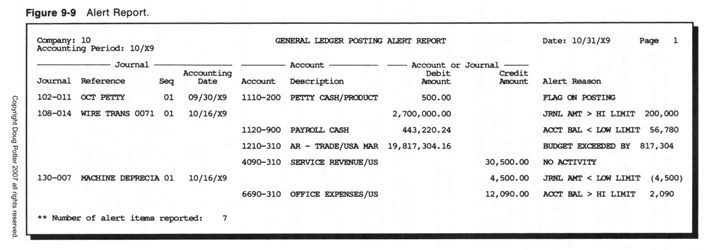

Account Alert Reporting. The account alert report is an exception report. For each item listed, the report identifies a condition that occurred during posting that may require further investigation. These conditions, based on parameters set up in advance by an accountant, can include identifying posted journal entries that

• Are posted to an account that was coded to report all journal activity it receives.

• Contain an amount above or below a specified limit for that account.

In addition to reporting journal entries, the account alert report may report accounts that

• Have no journals posted to them.

• Have a balance above or below a specified limit.

• Exceed their budget by a certain amount or percent.

Most of these thresholds can be set company-wide for each accounting company and overridden for an individual general ledger account. Thus the company table and the general ledger master file will have several alert indicators and limits that can be set, each enabling particular alert conditions. The system may allow these limits to be stated in absolute dollar amounts or percentages.

The purpose of alert reports is to pinpoint potential problems as they occur during posting. This may prove useful in

• Monitoring activity that posts to infrequently used balance sheet accounts, such as treasury stock and long-term debt.

• Reminding the accounting department that activity has not occurred on certain accounts that should receive activity each period.

• Reporting extreme variations in account balances as soon as they occur.

Alert reporting provides an additional, perhaps secondary review of account posting activity. The general accounting department's period end review of all general ledger activity for the period (as well as management's review of the financial statements) serves as the primary means of verifying general ledger posting and accounting activity. However, if used properly, alert reporting can off-load this primary responsibility and assist with early identification of potential problems, thus offering a secondary level of protection.

Figure 9-9 shows as account alert report. To be useful, an accountant must report once it is follow up on any suspicious items. Without this review alert reporting becomes ineffective.

Account Reconciliation Reporting. Accountants are commonly faced with a need to validate that certain journal activity eventually becomes completely offset by subsequent journal entries. Examples of this include

• Tracking a prepaid expense, to be sure that it is eventually converted completely to an expense.

• Seeing that a travel advance later becomes offset when it is reported on the employee's expense record.

• Noting that the asset value for a particular machine (accounted for in one account that includes many other capital assets) is eventually completely depreciated through depreciation expense entries for that individual machine.

• Noting that whenever an entry occurs to a suspense account, an offsetting entry later reverses that individual entry.

These situations involve interaction below the general ledger account level. They require tracking detail at the journal entry level, with certain journal entries off setting other journal entries. For example, assume that a travel advance of $1 000 is paid to a particular employee. This results in an entry:

DR Travel Advances $1,000

CR Cash $1,000

The Travel Advances expense will eventually be offset by a specific accounting event caused when the employee submits an expense report. This will result in the offsetting journal entry:

DR Frank Eberhart-Employee Account $1,000

CR Travel Advances $1,000

But because the Travel Advances account contains amounts advanced to many different employees, the account itself cannot identify when a reconciling event has occurred. The original journal entry must be set aside as a reminder that one or more offsetting journal entries must necessarily follow.

The general ledger system assists with this by setting aside unreconciled journal entries after posting them. The system will report these unreconciled journal entries on a listing such as the one shown in Figure 9-10.

Once the offsetting journal entries are posted, the system will remove the unreconciled entries and report both the original and offsetting entries together on a reconciled items report. The system usually produces reconciliation reports during posting. '

Alternatives to Account Reconciliation.

Before implementing account reconciliation, consider that a few alternatives exist to using this feature. First, an accountant can set up a general ledger account for each reconciling item (such as each employee, each particular asset, or each prepaid item). The reconciliation will then involve monitoring the account to identify that the balance at some point is reduced to zero. Unfortunately, the account maintenance and resulting clutter in the chart of accounts generally make this approach quite undesirable.

A second, and perhaps obvious, alternative to this reporting mechanism is to perform this matching and detailed account management in the appropriate subsidiary ledger system. This preferred approach can help in areas where an effective subsidiary accounting system tracks financial activity on a much more detailed level. Examples include

• Tracking individual asset depreciation in the fixed asset system.

• Managing employee advances in the payroll system.

Unfortunately, not all general ledger accounts have a corresponding subsidiary ledger system. In such cases, general ledger account reconciliation reporting may be the best approach for tracking reconciling items when such accounting is necessary.

NEXT MONTH'S TOPIC: Period End Processing