DEFINING REPORT LINES

All one-dimensional financial report writers have a specific approach for defining the lines in a report. This means not only defining a report line according to specific account information, but also allowing the definition of report lines as totals or differences of other lines. There are three common design approaches for this.

Selecting a Set of Accounts. The quickest way that a system can allow custom report lines to be defined is by using a single record selection. Here, the accounting analyst defines the report through a set of specifications, or instructions, that extracts a subset of account records from the general ledger master file. Typically the system selects records by identifying

• A range of accounts.

• A list of account numbers.

• A mask on the account number.

• A particular detail or summary budget center in a financial reporting structure.

• Records with account balances (or even other fields) that satisfy a specified condition, for example, accounts with a budget variance over $100,000.00.

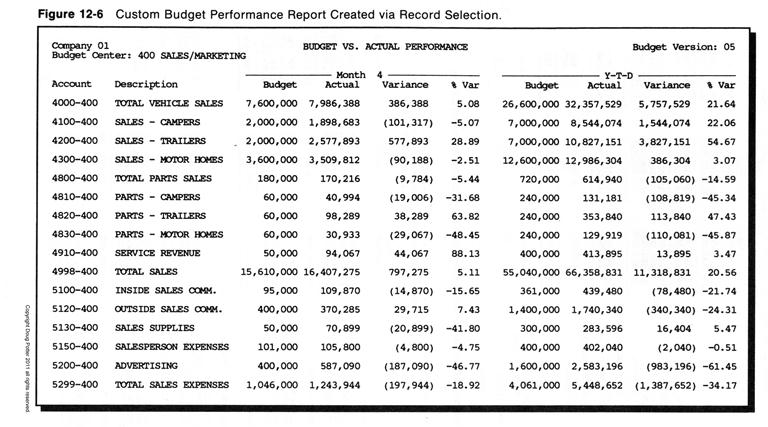

In financial reports created in this manner, each line on the report usually corresponds to an individual record in the general ledger file . Figure 12-6 shows an example of this. This approach essentially creates a custom report whose lines are a list of selected accounts. Totals computed in the report can come either from summary natural accounts or from a financial reporting structure.

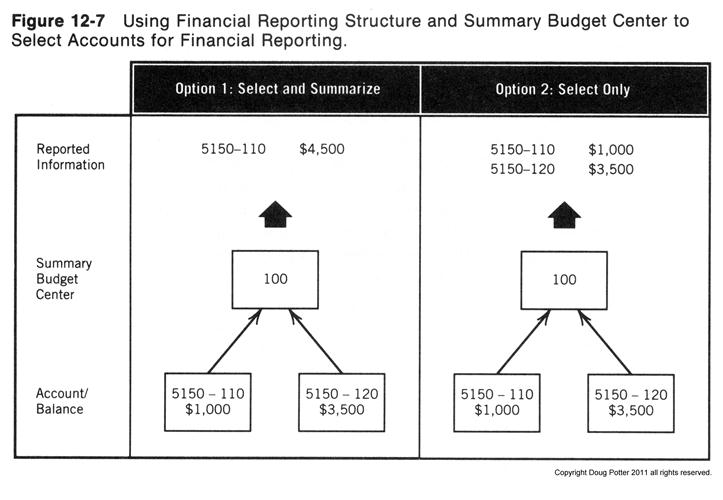

Depending on the particular system's capabilities, the financial reporting structure may be used in either one of two different ways that support financial reporting. When used to “select and summarize” the accounts, this structure stretches across multiple budget centers or accounts to define a total computed from the underlying accounts (Figure 12-7, left column). When used only to select the accounts (Figure 12-7, right column) the financial reporting structure serves as a short cut for listing the accounts by account number or range.

Storing Report Information with Each Account. Another way that general ledger systems define lines on a custom financial report is by storing report line information as part of the account record. In this design, each account record contains information that “points to” a particular line number on the custom report. The more data elements on the account record that serve this purpose, the more reports that can be produced in this manner. Unfortunately, this approach limits the number of account record data elements and thus the number of custom reports that it can support.

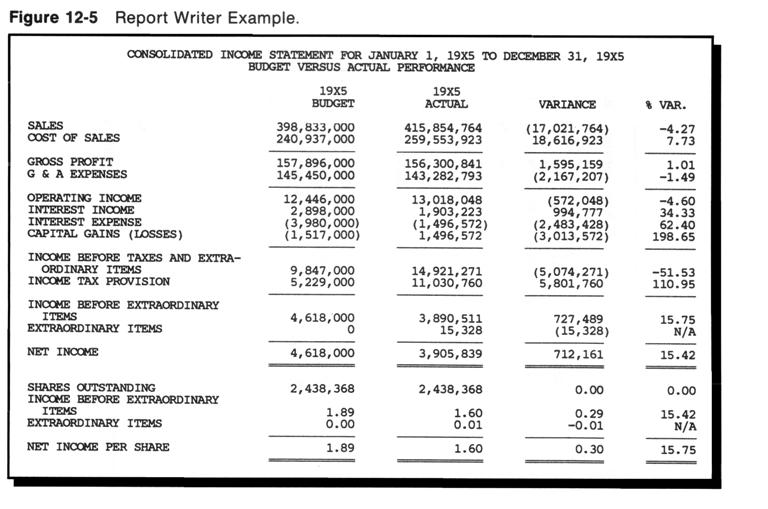

Summary financial reports, such as the financial statements in Figure 12-5, show a good example of how this custom reporting feature may be used. This approach easily allows the summarization of all individual accounts into a few report lines. However, if a general ledger system allows this manner of custom financial reporting, it should also provide the ability to list, by report line number, all account numbers that accrue into that line. This breakdown is most helpful in auditing and understanding the make-up of any custom financial report produced in this manner.

Storing Report Specifications Externally. Storing the record selection information external to the account record overcomes the disadvantage of the previous approach—that is, a fixed number of custom financial reports. By storing the report specifications external to each account record, the system does not have this constraint on the number of financial reports.

Under this approach, each report specification includes individual report line specifications describing the accounts that make a particular line. Just as the previous approach required each account to identify the report lines into which an account is mapped, this one requires identifying (in the report specification) the individual accounts that map into each report line. The financial report writer can embellish this by allowing, in lieu of a list, a range of accounts, or a mask to identify a particular set of accounts.

Two factors set this approach apart. First, unlike either of the two previous approaches, this provides an easy audit trail describing the content of each report line. Second, this technique is easily adapted to producing either summary financial reports, such as the one in Figure 12-5, or line item account listings, such as the one in Figure 12-6.

With this approach, whenever a new account is added to the chart of accounts, it will also need to be added to the appropriate report specifications. However, it is likely that in the future, general ledger systems will ask a series of questions regarding a new account. Answers to these questions will allow the system to update these report specifications automatically, whenever a new account is added.

When deleting an account, the system should automatically delete all references to it in a report specification. To assist with this, the financial report writer may provide a listing of all custom report formats affected by each particular account number.

NEXT MONTH'S TOPIC: DEFINING REPORT COLUMNS