By Doug Potter

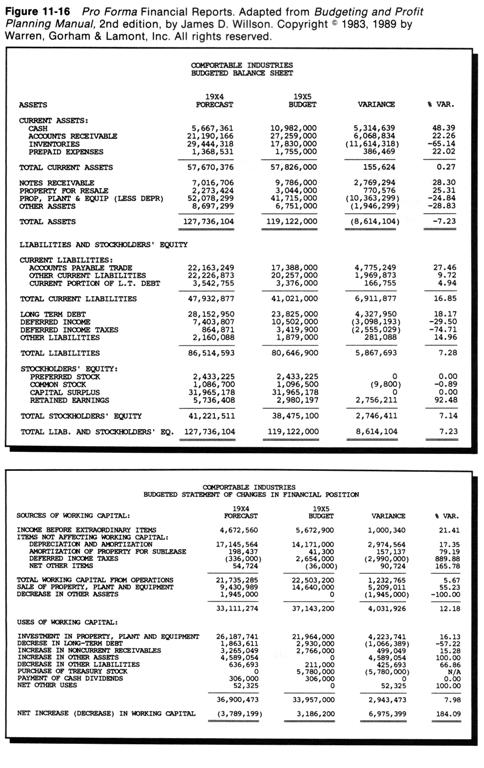

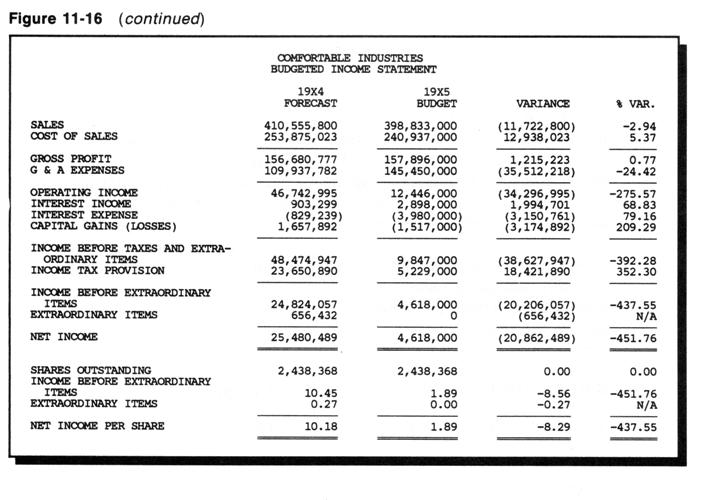

Pro Forma Financial Reports. Although the detailed budget listing shows account budgets for any budget center, the system will also prepare consolidated report formats, such as the set of pro forma financial reports shown in Figure 11-16. This format becomes most helpful when all of the budget managers have completed their effort and the controller must examine the combined results of all their work. The system can prepare the results of Figure 11-16 using the same report writing features and financial reporting structures that it uses for actual and actual versus budget combined and consolidated reports.

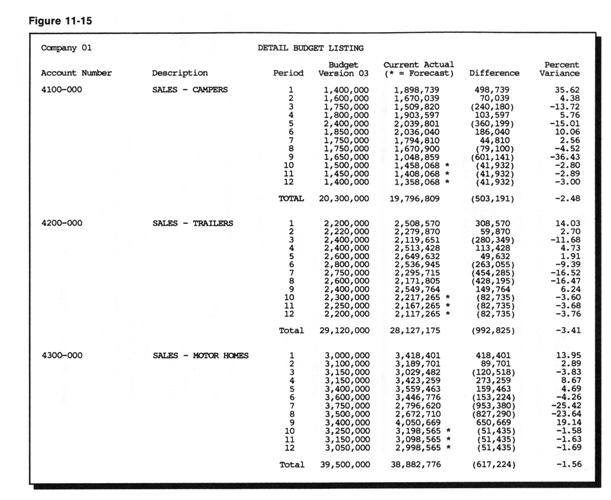

Final Budget Reports. At the completion of the budgeting and profit planning process, the system will prepare budget reports for each budget center indicating its budget for the coming year. Information in these reports is summarized along responsibility reporting lines and prepared in a format that identifies expectations of performance for each period. The format shown in Figure 11-15 provides a useful approach for presenting this because it shows expectations relative to current performance.

11.5 BUDGET DEVELOPMENT AT REMOTE LOCATIONS

Some organizations allow their remote branches, divisions, or subsidiaries to maintain their own accounting systems, separate from the central accounting system. In this situation, when managers at the remote locations are involved in the budgeting process, several different possibilities arise with respect to supporting local needs for budget development and budget versus actual performance reporting. Briefly, these needs can be met by

1. Central budget development.

2. Locally developed budgets forwarded to the central location, or

3. A distributed general ledger data base ,

Remember that the ingredients of this scenario are a centrally run general ledger accounting system, a separate accounting system supporting one or more remote locations, and a need to involve the remote location in the budget development process.

CENTRAL BUDGET DEVELOPMENT

An organization may require that all budget development and budget versus actual performance reporting occur on the central system. In this case the remote accounting system merely serves as a ledger for capturing actual accounting information. All performance reporting occurs from budget and actual information stored on the central general ledger system.

Budget development under this scenario is a straightforward exercise, relying on the features of the central accounting system to develop the budget for each remote location. This simplistic approach avoids complicating issues, such as the combination of budget results from different, remote general ledger systems or using the budget development features of the remote general ledger accounting system(s).

If simplicity is an advantage here, it is also a disadvantage. Not being able to use the remote, i.e., local, general ledger accounting system for budget development and budget performance reporting usually introduces several inconveniences:

• Reliance on the central accounting organization to prepare period end performance reports, rather than using locally available resources.

• Receiving performance reporting information later than it would otherwise be available locally.

• Not being able to influence the structure and layout of reported information, as would be possible reporting budget performance on the local system.

REMOTELY DEVELOPED BUDGETS FORWARDED TO THE CENTRAL LOCATION

A complementary situation exists in environments that develop the budget remotely and forward budget information to a central location. The disadvantages mentioned in the previous approach become advantages under this approach. The basic advantage here is the flexibility provided to the remote business units with respect to local budget development and performance reporting.

Conversely the advantages of the previous approach become disadvantages under this scenario. The foremost issue is the need to produce a consolidated budget at the corporate location by combining budget information from both the corporate budget as well as all the remote locations. This should be a much simpler process than consolidating actual results from the remote accounting ledgers (Chapter 12). Usually the easiest approach involves three steps

1. Extracting appropriate account numbers and budget amounts for each period.

2. Transmitting this information to the corporate location.

3. Loading it to the proper budget fields on the designated accounts in the corporate ledger.

Once resident here, all budget information may be combined using a process that parallels the approach for combining actual financial information followed at the end of each accounting period. This combined budget information is used to produce pro forma financial statements and other summary budget reports.

Overall, the approach of using remotely developed budgets forwarded to a central location adapts very well to organizations that follow either a bottom-up budgeting approach or a hybrid approach to budget development. This approach is less effective with top-down budget development because it does not provide a readily adaptable means of communicating budget goals from the corporate organization to the remote business units. Usually this communication takes place outside the system.

NEXT MONTH'S TOPIC: DISTRIBUTED GENERAL LEDGER DATA BASE

Material in this chapter has been adapted and reprinted with the permission of Warren, Gorham & Lamont, Inc., from Chapter 43, “Automated Budget Systems,” in Budgeting and Profit Planning Manual, 2nd edition, by James D. Willson. Copyright 1983, 1989 by Warren, Gorham & Lamont, Inc. 210 South Street, Boston, MA 02111. All rights reserved.