By Doug Potter

ALLOCATIONS

Some businesses have financial accounting and reporting requirements that involve the allocation of account balances from particular accounts to other accounts that, by prearrangement, share a portion of the amounts being allocated. Although any type of account can be allocated, allocations most often involve expense accounts, such as for telephone expenses, word processing services, or computer department charges. System editing should ensure that allocations occur only among like types of accounts. That is, an expense account can be allocated only to another expense account.

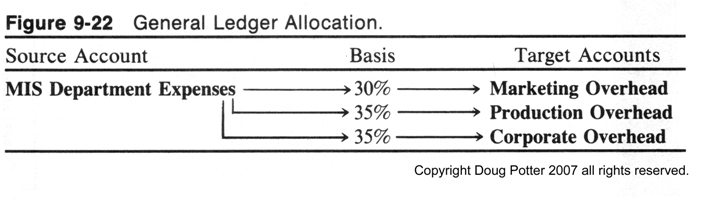

The general ledger requires three pieces of information for allocation to occur:

• The source accounts, which contain the amounts to be allocated.

• The target, or destination, accounts, which will receive the allocation.

• The basis, which will be used to divide up the source accounts and distribute them to the target accounts.

Figure 9-22 illustrates this.

The system may allow source accounts to be pooled so that it allocates each one identically. Any set of accounts that uses the same basis and the same target accounts can be treated in this manner. In the above example, this might be useful if policy does not call for the entire MIS Department Expenses account to be allocated, but instead calls for three specific accounts within this summary total to be allocated. If these three accounts are Paper and Supplies, Programming Department Salaries, and Direct Departmental Chargebacks, then an accountant would pool these three accounts and identify that pool as the source for the allocation.

Static and Dynamic Allocation. In static allocation, the allocation basis remains the same each time the allocation is run. The system may allow this fixed amount to be specified using any of several different ways. Two common approaches are as a set of relative percentages (Figure 9-22) and as a set of absolute numbers that become translated to percentages based on their total. As an example of this second approach, consider that job shop manufacturers often set up their manufacturing departments as profit centers. For departmental profitability reporting, the general accounting department may use the (fixed) number of square feet in each manufacturing department to allocate overall building depreciation back to each profit center. The system translates these square footages into relative percentages when performing the allocation.

Some businesses may require that the bases not add up to 100 and that some portion of the source account(s) remains unallocated. Not long ago, a particular industrial products manufacturer started charging each of its two dozen autonomous divisions a flat 1 of all corporate overhead costs. Leaving aside the managerial accounting implications of this approach, the general ledger system was required to accommodate this via an allocation that, of course, consumed only 24 of the source account's balance.

In static allocation the basis is a set of fixed numbers whereas in dynamic allocation it is a set of variables, each one the balance in a general ledger account. Most often these dynamic basis accounts are statistical accounts that hold activity, such as the number of employees in a particular department. Examples of dynamic allocations include allocating telephone expenses to departments based on departmental headcount or allocating photocopying and reproduction department expenses based on the number of documents copied for each department. Dynamic allocations require the statistical bases to be updated as necessary to keep them current.

Alternative System Designs for Allocations. General ledger systems employ either one of two alternative designs for processing allocations in the chart of accounts. In one approach the general ledger system uses a special field associated with each general ledger account record to receive amounts allocated to that account. This approach has the advantage of allowing financial reports to be produced either including or excluding allocation amounts. When including the allocation amounts, the system computes the reported account balance by adding both the traditional account balance and any amounts that have been allocated to that account.

As an alternative, more common design approach, the general ledger system can create journal entries that move allocated amounts from the source accounts to the target accounts. Although somewhat less flexible, this approach is quite practical and indeed less complex since the system does not have to address the issue of a separate allocated balance for target accounts.

Using either design the system can perform a test allocation run that does not post the computed allocation amounts, but instead computes them for reporting purposes only. This allows the allocation results to be reviewed for correctness before their final computation. This feature is particularly important in systems that use the second design approach.

Other Allocation Features and Considerations. The general ledger system uses an allocation table to retain information required for allocations. Each allocation receives an identifying allocation number that not only uniquely references each table record, but allows an accountant to control the sequence in which all of the allocations occur.

This sequence becomes important when circumstances require allocating the results of previous allocations. For example, a large organization may allocate corporate overhead costs back to regional distribution centers. Each of these distribution centers may, in turn, allocate their own overhead (including corporate overhead) back to individual departments. These two allocation steps must be computed in the proper sequence in order to achieve the desired result.

The allocation process can occur either during period close processing or during posting. It may affect not only actual amounts, but also budget amounts.

Normally allocations occur only within one accounting company but certain general ledger systems allow for intercompany allocation. As an audit trail of the allocation process, the system should produce a detailed report, listing each source account and the corresponding amounts allocated to each target account from that source account. The system may also produce a listing of all the target accounts indicating amounts allocated to them, by source.

NEXT MONTH'S TOPIC: Chart of Accounts