Account Inquiry. The general ledger system will provide inquiry capabilities so that the general accounting department (and others, as required) can view account balances on-line. To facilitate this, the system may allow perusal of accounts based on a partial account number or account description. By displaying all accounts and their descriptions that match this partial identification, an accountant can easily identify a particular account to examine in further detail.

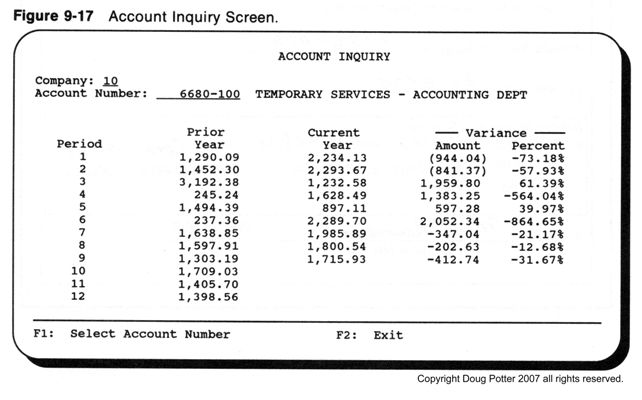

Figure 9-17 shows a general ledger account inquiry screen that lists detailed period-by-period activity compared with the prior year. This is only one of many formats available for displaying account information. Other formats can be created by using different comparisons, such as budget versus actual comparisons.

In addition to this comparative element, the general ledger inquiry screens may differ by how they represent the account amounts: the detailed period by period format of Figure 9-17 is very popular, but some situations call for quarterly or year-to-date totals to be shown.

The system should restrict account inquiry so that each budget center can look only at its own account balances. Key accounting department personnel and the budget center manager should be the only ones allowed to view this information for particular accounts.

Mass Maintenance. Mass maintenance, or high-volume maintenance, allows s an accountant to easily set up an entire range of accounts, complete with everything except financial account balances. This feature works by adding either a new row or a new column to the matrix of natural account numbers and budget centers by copying information from a designated row or column.

A mass maintenance feature is helpful for setting up new budget centers. For example, an accountant can use it to copy all the accounts from a designated (existing) budget center to a new one. Mass maintenance can also help set up a particular natural account number that affects a range of budget centers. For example, this may be helpful in setting up new general ledger classifications for salary expenses that will affect each department or budget center.

These examples all refer to a two-dimensional account number consisting of natural account and budget center. With respect to a multidimensional account number, mass maintenance is necessary whenever a particular dimension receives a new value in its domain. Consider, for example, the needs of a retailer using the three-dimensional account number:

Natural Account Store Number Department

XXXXX -- XX -- XXX

Mass maintenance can facilitate setting up new accounts with a complete set of Natural Accounts and Departments whenever a new store is added.

Some companies take advantage of mass maintenance capabilities by using a specific set of accounts, defined under a "master" budget center, as the source for creating new accounts. Even though these accounts may not hold any account balances, they can serve as a template for setting up a new budget center. This helps maintain uniformity among the different accounts in the general ledger—a quality that can be quite advantageous.

To help avoid the spread of unnecessary, unused accounts through frivolous use of mass maintenance, the accountant setting up new accounts should review the resulting accounts just created and delete any that will not be used. Not long ago, the proliferation of accounts through mass maintenance got out of hand at a particular commercial product manufacturer's newly acquired division. When inspecting the new division, the president of the new parent corporation questioned why this division had about five times the number of accounts as the company's other divisions. The division's accounting manager explained that their environment was extremely complicated and required this number of accounts » for its accounting procedures. The truth was that these accounts had been created through unchecked use of mass maintenance and that most of the accounts were not even being used.

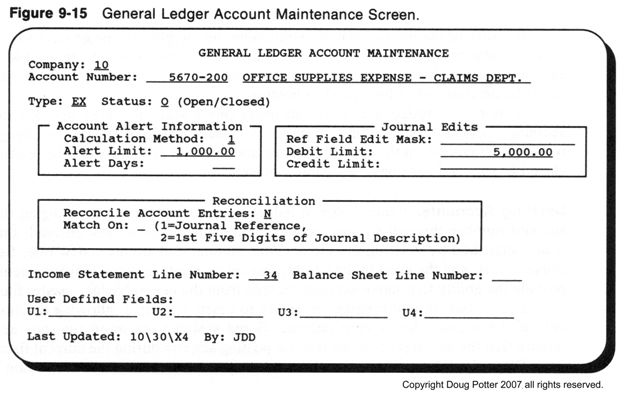

In addition to using these capabilities for setting up new accounts, the system may also employ a mass maintenance feature for making wholesale changes to the account fields shown in Figure 9-15. This works by specifying the new values for particular fields and indicating the range of accounts to which this change applies. For example, to close a range of open accounts, all the accountant needs to do is specify "C" for account status and identify the range of accounts to be closed.

JOURNAL HISTORY FILE

Modern general ledger systems retain all posted journal information in a history file. This information is often queried or reported on two different ways:

• Via account number, to perform analysis on a general ledger account's posted activity.

• By journal number, to access entire journals.

Notice that an important difference between these is that the first involves journal detail, i.e., journal line items, and that the second involves the entire journal.

Account Activity Analysis. Journal history information is extremely useful for assisting with account research and with special requests. It can provide quick answers to questions, such as

• Why don't company cash account balances reconcile with the bank's?

• Did the accounting department post the interest accruals for the current period yet?

• Why is there $16,000 of accumulated depreciation in a particular account?

• Do the financial results shown in the income statement printed on 02/05/X5 include all final adjustments for the January period?

• How much payroll expense is created, each time the weekly payroll is run?

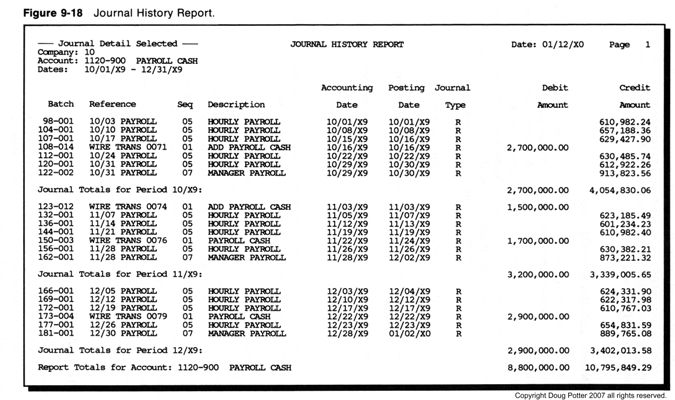

General ledger systems allow an accountant to view account activity by specifying certain selection criteria, such as a range of accounts and/or a range of accounting dates. Once selected, this set of journal detail items can be printed on a report or displayed on-line as a list of items, each one available for detailed inquiry. Figure 9-18 shows a report of journal history useful for analyzing company cash account balances. This journal history report does not list account balances and serves only as a means of reporting journal detail available in the general ledger history file. Notice how this information is similar to the general ledger report. The system uses the journal history file in preparing the general ledger report.

Journal Access. The system may also use the journal history file to extract full, complete journals for purposes, such as

• Inquiry display of a complete journal.

• Reporting or other access to a complete set of posted journals, so that the journal preprocessor can reprocess them against a different ledger.

As an example of this second point, the journal history file may provide journals to a journal preprocessor to update particular "back-end" ledgers, such as a project ledger. The preprocessor can select and prepare historical journals posted earlier that month for keeping this project ledger current with the month's expenses.

The system will access the posted journals, not according to their account number, but according to information used to reference the overall journal, such as batch number(s), journal reference, journal description, or some other specific identification of the requested journal(s).

NEXT MONTH'S TOPIC: Inquiry General Leder System Tables