Accounting Concepts:

General Accounting and Related Business Processes: The Role of General Ledger - Part 1

This is the 1st article in a series about General Accounting and Related Business Processes. This material is adapted from The Automated Accounting Systems and Procedures Handbook (John Wiley, New York 1991) Chapter 9.

By Doug Potter

9.1 THE GENERAL LEDGER SYSTEM’S ROLE

The general ledger is the central repository and ultimate destination of all corporate financial information. It is the most significant source of financial reporting of all the accounting systems. For these reasons the general accounting department relies most heavily on the general ledger system to support its efficient operation.

As subsidiary accounting systems, the other financial accounting systems discussed in this text help off-load some of the general ledger's data collection and reporting responsibilities. However, the general ledger system itself is unique among all accounting systems, serving the needs of not only the general accounting department, but of all levels of management—from line managers to executive management. In broad terms the main purpose of the general ledger system is collecting financial information in the chart of accounts and, from this, preparing financial and management reports. The system must satisfy all financial reporting requirements not being met by the subsidiary accounting systems. In most environments this leaves the general ledger system with a key role in

• Period end financial reporting.

• All areas of responsibility reporting.

• Summary reporting for executive management.

• Special-purpose financial reporting.

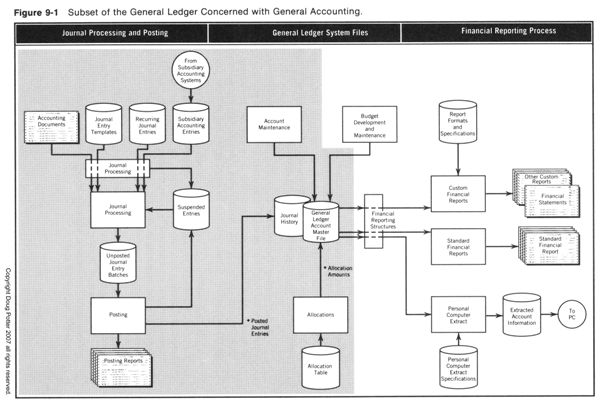

Figure 9-1 presents an overview of the functions of the general ledger system. The area marked in gray shows those system functions that assist the general accounting department in performing their corporate accounting duties. This chart serves as a helpful orientation, but on closer inspection this entire framework becomes much more intricate. A modern general ledger system has a significant number of features and capabilities that embellish its basic functions of assisting in both the collection and reporting of financial information. To complicate matters, different general ledger systems use a variety of alternative approaches and designs to accomplish similar tasks. This chapter provides a comprehensive examination of the general ledger system's service to the general accounting department, including a look at alternative implementations of particular system features and capabilities.

9.2 AUTOMATED GENERAL ACCOUNTING

Several compelling reasons support the need for an effective, well-automated general accounting environment:

1. Accuracy. Accurate accumulation of underlying financial information is an intrinsic requirement of any accounting system. This is particularly true of the general ledger system. An automated general ledger system provides a set of tools that supports the mathematically correct accumulation of account detail.

2. Completeness. Accounting information is said to be complete when it includes all appropriate detail. For example, an amount reported for accounts payable is complete if it includes an accrual for goods received with no matching invoice. When properly used, the features of an automated general ledger help the accounting department maintain complete accounting records. This stems from the system's ability to manage masses of journal entry and account data in a consistent and thorough manner.

3. Timeliness. Timely period end closing and financial reporting is every controller's goal. Good accounting practices aid in accomplishing this, but an automated system can play an indispensable role, particularly when accounting information must be combined and consolidated from geographically separate business units: The postal system cannot hope to match the speed of electronic data transmission. Even when distance is not an issue, certain system features, such as standard journal entry templates, provide indispensable support for the timely processing of general accounting information.

4. Accounting Department Cost Containment. Modern businesses rely heavily on automated systems to efficiently conduct the general accounting department. An effective system provides a vehicle for containing departmental expenses and staffing levels. As business volumes rise, the incremental demand on the accounting department can be more easily met without adding new staff.

5. Information Access. The features and capabilities presented in this chapter provide financial management with efficient access to an abundance of historical and current accounting information. In a sense, this supports accounting department cost containment because without these tools, the department's responsibility for preparing necessary financial information could require much more effort.

6. Auditors. Internal and external auditors often examine the general ledger system, testing the accuracy of the financial information it produces and perhaps the effectiveness of supporting systems and procedures. A well-controlled and well-managed environment will help satisfy their requirements and contribute to a smooth, successful audit.

Achieving success in each of the aforementioned areas is a goal of every accounting department. Accomplishing this requires not only a good set of tools, but the proper procedures in place to use these tools.

SYSTEM FLOWS

Figure 9-1 shows how information flows from the journal entry cycle into the general ledger system files. These system flows follow three cyclical activities that are the primary responsibilities of the general accounting department:

• Journal processing.

• Posting.

• Period end processing.

This chapter discusses each of these activities in more detail. Notice that period! End processing does not exist as a separate process in Figure 9-1. Period end processing uses nearly all of the system's parts shown.

Notice also how information flows into and out of the general ledger account master file and the journal history file. These files form the heart of the system; they serve as the central repository or database for the general ledger system. The general ledger master file retains all detail associated with the chart of accounts and is perhaps the most crucial of all general ledger files. Some general ledger systems may physically store chart of account information in more than one separate file, creating a database consisting of several files. This text views all such information as residing in one file that contains the complete set of amounts, options, values, and budgets associated with each account.

INTERFACES WITH OTHER SYSTEMS

When one thinks of interfaces between the general ledger and other systems, the most likely thought is the flow of information from other subsidiary accounting systems into the general ledger. The common role here, as in any modern, integrated environment, is the general ledger's position at the receiving end of all accounting information. However, many organizations have integrated accounting environments that involve the flow of information back out of the general ledger system into other subsidiary accounting systems.

Interfaces from the General Ledger System into Other Systems. Some organizations use general ledger systems to prepare financial information for input into a project control system to track financial activity by project. When overhead allocation to specific projects is necessary, this "back end" interface can be particularly helpful for sending allocated costs computed in the general ledger to the project control system. Uses for this approach include capital project tracking and control, construction project control, and similar specialized project control applications.

Another "back end" interface from the general ledger can allow financial information to flow from the general ledger into a decision support or financial modeling system. Businesses use this approach to integrate the financial modeling system into the general ledger chart of accounts. Should the organization desire to use the financial modeling system to build financial budgets, this interface must also go in the reverse direction, allowing calculated budgets to be loaded back into the general ledger.

Non-financial Information in the General Ledger. An organization can use a great deal of imagination in deciding what information flows into the general ledger. Modern accounting systems offer the flexibility of receiving and storing statistical as well as financial activity. This provides a powerful tool for preparing key indicator reports out of statistical (and financial) information forwarded from subsidiary accounting systems.

General ledger features for allocation, budgeting, and custom report formatting all require statistical information. Because of the wealth of statistical information held in application systems outside of the general ledger, these other systems become an effective source for forwarding statistical activity to the general ledger for management and financial reporting.

Next Month's topic: Journal Processing

|

About Author: |

Doug Potter is the owner of The Newport Consulting Group a professional management consulting organization that provides clients with information systems planning, selection, and implementation services. He can be reached at dpotter@newportconsulting.com or through his Web site, http://www.newportconsulting.com.

Note: The contents of this article were excerpted from Mr. Potters book "Automated Accounting Systems and Procedures Handbook" Copyright 1991 by Douglas A. Potter, published by John Wiley & Sons, Inc. New York

Contact info:

Doug Potter

Newport Consulting

Email: dpotter@newportconsulting.com

Website: www.newportconsulting.com

|

|

BillQuick – Time, Billing and Project Management

With BillQuick, all your critical business functions—time and expense tracking, project management, billing and accounts payable—are in one system. If you are already using QuickBooks®, Peachtree Accounting® or MYOB®, you can leverage your existing investment by integrating with BillQuick. You can also get the mobility you desire with BQE’s feature-rich SaaS product which also comes with an iPhone and Android mobile app.

Recently rated five stars by CPA Practice Advisor!

Click here to learn more

|

Free Accounting Software Search

Our complimentary software search service will help

you locate software providers specializing in your business to help you with all your software needs.

It's simple, easy and only takes a few minutes.

Click here to start your free software search.

|

|