MULTIDIMENSIONAL ACCOUNT NUMBERING AND IMPLICIT VS. EXPLICIT APPROACHES

Implicit Approach. As indicated earlier, in a general ledger system with an implicit approach to defining the reporting structure, multidimensional account numbering may be the only means by which different financial reporting structures can be implemented. This requirement to build separate components into the account number for each particular financial reporting structure is a significant drawback of the implicit approach. Even if the particular system uses coded fields in the account master record to establish multiple, implicit financial reporting structures, a limitation exists. Specifically, general ledger systems with this implicit approach tend to restrict the number of financial reporting structures that any particular chart of accounts can use. This limit is imposed by the size of the account number or the number of master file fields used as a "handle" by the reporting logic.

Explicit Approach. General ledger systems with explicitly defined financial reporting structures generally do not have this disadvantage. With such general ledger systems, multidimensional accounts are more of a refinement to help meet business reporting needs than they are an absolute requirement for implementing multiple financial reporting structures. In fact, many general ledger systems do not yet offer multi-dimensional account flexibility because reporting needs for multiple financial reporting structures can be satisfied without true multidimensional account features.

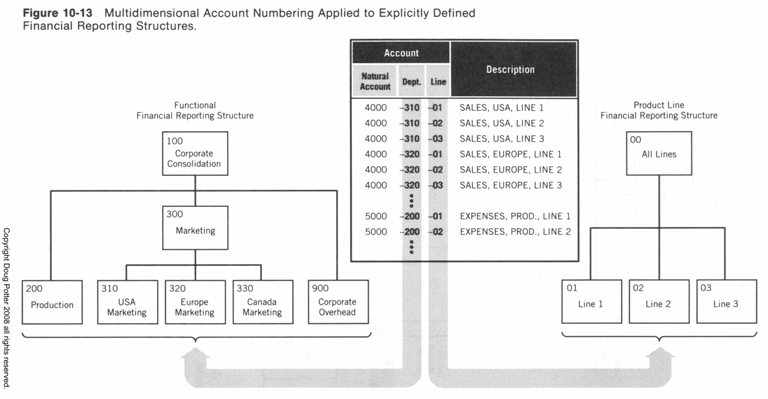

To understand this better, first consider how multidimensional account numbering works in a system that uses an explicit financial reporting structure. Basically, each component creates a separate access path or linkage between the chart of accounts and the detailed budget centers in the financial reporting structure. Referring to Figure 10-13, this means that separate linkages connect the chart of accounts to individual financial reporting structures via components in the account number. Each linkage requires a different set of detailed budget centers.

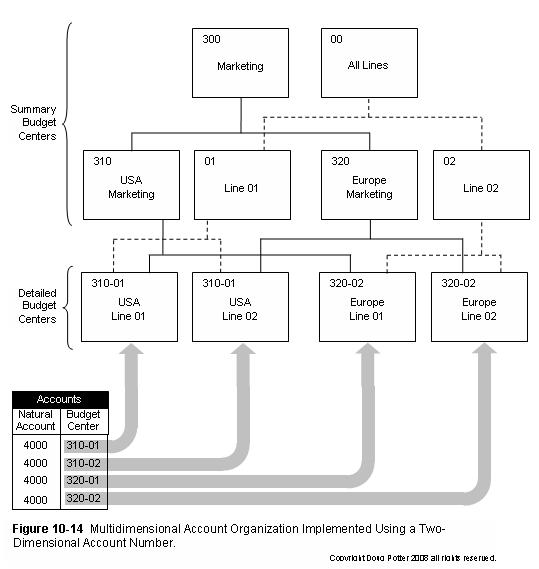

Multidimensional account numbering, is a nice feature to have, but it is not absolutely necessary. Even a two-dimensional system with only one access path can simulate these multiple linkages via a more complex organization of the budget centers. Figure 10-14 shows this. Here the business requirement of a three-dimensional account number is met by a more complicated set of reporting structures and one linkage, that is, one set of detailed budget centers. Even though each detailed budget center is coded to include both department and product line, the system is still essentially relying on a two-dimensional account numbering scheme of natural account and budget center.

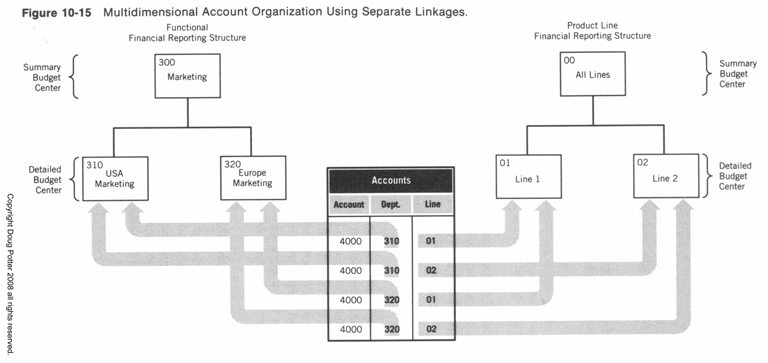

Figure 10-15 shows the same example as Figure 10-14 using two linkages. This illustrates true multidimensional account numbering. Notice that this three-dimensional design requires four explicitly defined relationships in the reporting structure whereas the two-dimensional design requires 12. This simpler result is the primary benefit of true multidimensional account number (over the "simulated" approach shown in Figure 10-14). Unfortunately many general ledger systems with explicitly defined financial reporting relationships still allow only one linkage between the chart of accounts and the budget centers, thereby supporting only two-dimensional account numbering.

Notice the power that a general ledger system has when it explicitly defines the financial reporting relationship and allows multiple linkages. Not only can it use each component of the chart of accounts to link to a particular financial reporting structure, it can also allow multiple financial reporting structures to exist for any particular component!

FINANCIAL REPORTING STRUCTURES THAT CROSS ACCOUNTING COMPANY LINES

Until now, the discussion has considered meeting financial reporting needs that exist wholly within a particular accounting company. Many times an organization's financial reporting requirements must be met by using a financial reporting structure that crosses accounting company lines. Examples include:

• Financial or management reports containing information from many different accounting companies.

• Responsibility reporting for managers whose span of control crosses several accounting companies.

• Full financial consolidation of accounting information from different legal entities.

General ledgers with implicitly defined reporting structures implement cross-company financial reporting structures via account selection across company lines. When the financial reporting processes run, they simply select detailed accounts for totaling and reporting from more than one accounting company.

Other systems use explicitly defined reporting structures that attach to detailed budget centers in different accounting companies. In this manner, financial reports can use a reporting structure to combine, consolidate, or report information from different accounting companies.

NEXT MONTH'S TOPIC: Financial Accounting Periods